BoBe App is an AI-powered DeFi platform on BNB Chain delivering sustainable USDT rewards through automated, risk-managed spot trading. Since launching its mainnet, BoBe has demonstrated strong early traction, executing over 5,000 trading positions, distributing nearly 19,622 USDT in rewards, and generating more than 9.3 million USDT in transparent, on-chain trading volume.The platform operates on a simple “Swap. Bake. Earn.” model, where users stake $BOBE tokens and earn daily USDT rewards generated by AI-driven spot trading across major exchanges such as Binance, KuCoin, Bybit, and OKX. By avoiding leverage and focusing solely on spot markets, BoBe emphasizes capital preservation, stability, and real yield from live market activity.BoBe’s ecosystem is expanding rapidly through strategic partnerships in AI, blockchain infrastructure, and community development, including NeroX AI, Collably Network, ENI, Digika, and major regional crypto communities. The platform is triple-audited by CertiK, Beosin, and Cyberscope, reinforcing its commitment to security and transparency. With an average APR of 25–40% and upside potential up to 45%, BoBe positions itself as an accessible, emotion-free DeFi solution for both Web3 and Web2 users.

BoBe App is a DeFi platform that implements artificial intelligence for automated spot trading and sustainable USDT yields on BNB Chain. The company reports strong early mainnet performance and rapid ecosystem growth, supported by strategic partnerships.

Since its mainnet launch, BoBe has executed 5,064 trading positions, distributed nearly 19,622 USDT in rewards, and facilitated over 9,300,000 USDT in total trading volume. All activity is transparent and verifiable on-chain. This supports BoBe’s focus on real yield from live market execution rather than theoretical results.

The core idea for the platform’s end users is very simple: BoBe’s “Swap – Bake – Earn” model. Users swap for $BOBE and stake tokens in the Bakery, where the Gamma Protocol-powered AI tools and analytics execute risk-managed spot trades across leading exchanges, including Binance, KuCoin, HTX, Bybit, Bitget, and OKX. By operating exclusively in spot markets with no leverage, BoBe prioritizes capital preservation, stability, and consistent USDT rewards.

“BoBe is built to make DeFi accessible, transparent, and emotion-free,” said Denis Kurilchik, CEO of BoBe App. “These metrics validate our AI trading engine and the trust of our growing community. Through partnerships in AI, blockchain infrastructure, and community networks, we are accelerating adoption. We are building a sustainable ecosystem where users earn from genuine market activity.”

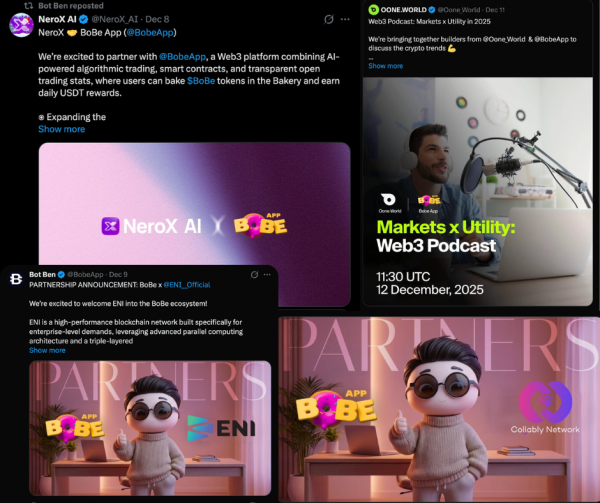

Expanding the BoBe Ecosystem Through Strategic Partnerships

BoBe App has rapidly grown its ecosystem through collaborations focused on technology, education, and community activation:

- NeroX AI (@NeroX_AI): AI intelligence for alpha discovery and KOL insights. The partnership focuses on co-hosted community initiatives, educational programs, and joint marketing.

- Collably Network (@CollablyNetwork): A Web3 hub linking DeFi, AI, and gaming. The partnership expands project discovery, transparency, and collaboration.

- ENI (@ENI__Official): An enterprise blockchain for scalable multi-chain infrastructure, collaborating with BoBe on advanced application development.

- Digika (@digikaai): An AI/blockchain freelance marketplace. The partnership aims to expand the use of AI and the development of real-world Web3 applications.

- HP Calls (@hpcalls): Vietnamese crypto community of 50,000+. The partnership supports BoBe’s regional growth via education and campaigns.

-

Additional partners GF Capital, Joker Capital, Flamingo Capital, Gem Incubators, and Crypto Hunter expand BoBe’s reach in trader and educational networks.

Key Performance and Platform Highlights

- Closed Positions. 5,064

- Total Rewards Distributed. 19,622 USDT

- Trading Volume. 9,300,000 USDT

- Bake & Earn Model. Bake (stake) $BOBE with daily USDT rewards. Current APR (Annual Percentage Rate, the yearly rate of return) averages 25-40%, with performance-based upside potential of up to 45% through compounding, possibly even more.

- Security and Transparency. Triple-audited by CertiK, Beosin, and Cyberscope, with open-source contracts and real-time on-chain verification.

- Community Incentives. Active TaskOn campaigns, a 5-level affiliate system offering up to 15% commissions, and a Leadership Partner Program for KOLs (Key Opinion Leaders, or recognized community leaders and influencers) and ecosystem builders.

BoBe’s mainnet is fully live at bobe.app. Connect your wallet, swap for $BOBE, and start earning with the Bake & Earn model today.

About BoBe App

BoBe App is an AI-powered DeFi platform built on BNB Chain that delivers sustainable USDT rewards through automated spot-market strategies. By eliminating leverage risk and emphasizing transparency, security, and accessibility, BoBe aims to redefine emotion-free finance for the next generation of Web3 users.

Follow @BoBeApp on X or join the Bakers Club on Telegram for updates, support, and exclusive earning opportunities.

Contact

Denis Kurilchik, CEO

Email. info@bobe.app

Media Contact

Organization: BoBe

Contact Person: Denis

Website: https://bobe.app

Email: Send Email

Country:Thailand

Release id:39128