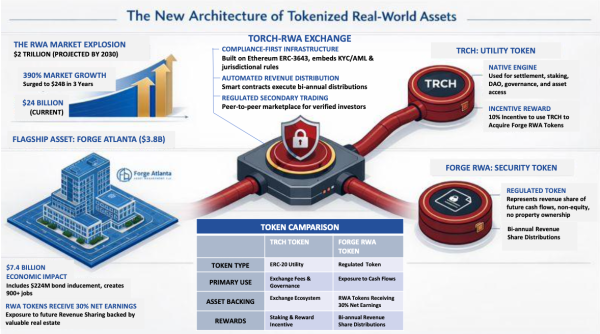

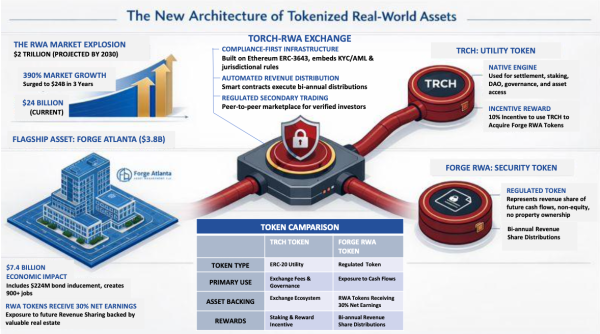

Torch, LLC is preparing to launch Torch-RWA, a regulated digital marketplace for tokenized real-world assets. The exchange will debut with the $3.8B Forge Atlanta, offering compliant token issuance, automated revenue distribution, and identity-verified trading. TRCH token holders gain unique ecosystem access, including a 10% reward for Forge participation.

“The tokenized real-world asset market has grown roughly 380% in three years to about $24 billion, and analysts project tokenized assets could reach around $2 trillion by 2030.” (1)

“Tokenized real-world assets have already crossed the $20 billion mark, and major incumbents like the NYSE’s parent company are now building 24/7 platforms for blockchain-based securities.” (2)

Atlanta, GA – February 4, 2026 – Torch, LLC announces a digital infrastructure exchange, Torch-RWA (https://torch-rwa.com/), to support the issuance and lifecycle management of tokenized real-world assets (“RWAs”), a regulated, TRCH-powered institutional-grade marketplace anchored by Forge Atlanta, a $3.8 billion multi-phase mixed-use development in downtown Atlanta sponsored by Webstar Technology Group (https://webstartechgroupinc.com/) (OTCPK: WBSR). Upon launch, the Torch-RWA marketplace is expected to enable eligible, KYC/AML-verified investors to gain fractional, on-chain exposure to a defined portion of Forge Atlanta’s future distributable cash flows through regulated security tokens, while the TRCH utility token is designed to power access, fee, and rewards functionality across the exchange. The Forge Atlanta tokenization listing is the latest example of digital capital markets evolving beyond traditional finance and development structures, enabling direct investor participation in projects once limited and inaccessible to most investors.

Torch-RWA will be a regulated digital infrastructure for the compliant tokenization of Forge Atlanta’s development, and other RWAs and does not act as a developer, owner, or financial sponsor of the underlying real estate project. Positioned as a compliant crypto-economic infrastructure, Torch-RWA integrates security token standards, automated compliance enforcement, and programmable revenue distribution, enabling real-world assets to operate within a legally enforceable blockchain framework.

Institutional-Grade Blockchain Infrastructure for Real-World Assets

Torch-RWA is built on Ethereum using ERC-3643 security token standards, embedding investor identity, jurisdictional eligibility, and transfer restrictions directly into smart contracts. This design enables full regulatory alignment across issuance, custody, settlement, and secondary trading.

Core infrastructure layers include:

- On-chain identity verification (ERC-734/735)

- Automated KYC/AML enforcement via Identity Registries

- Modular compliance and jurisdictional rule engines

- Third-party custodial wallets and escrow-based settlement, as applicable

- Automated on-chain revenue distribution

- Regulated peer-to-peer secondary marketplace

This architecture enables programmable ownership, auditable cash flows, and legally enforceable asset settlement within a single unified system.

“Torch-RWA is being deployed as regulated digital asset infrastructure—not as an experimental marketplace,” said Eric McClendon, CEO of Torch, LLC. “Our goal is to provide a compliant, auditable framework where real-world assets can transition onto public blockchains without compromising legal integrity, investor protection, or institutional standards.”

“Launching with a multi-billion-dollar institutional-scale tokenized real estate development like Forge Atlanta demonstrates the scale of real-world value this platform is designed to support,” the CEO added.

Forge Atlanta – Torch-RWAs First Flagship Institutional-Scale Asset

The exchange’s inaugural listing will be Forge Atlanta, a multi-phase downtown mixed-use Mega-Asset backed by Webstar Technology Group and designed by Nelson Worldwide. Forge Atlanta is being advanced by Webstar Technology Group and its subsidiary Forge Atlanta Asset Management within a multi-pronged capital structure that includes traditional institutional financing, a $223.7 million bond inducement approved by the Development Authority of Fulton County (3), and future project-level debt and equity. Torch-RWA is intended to sit alongside this conventional capital stack as a digital infrastructure layer that brings fractional access and programmable distributions to compliant investors.

Within the Torch-RWA framework:

- RWA Tokens Receiving 30% Net Earnings will be represented via regulated on-chain security tokens (These security tokens do not represent equity or ownership in any land, buildings, or real property associated with the development)

- Bi-annual revenue distributions will be executed through audited smart contracts (Payouts to token holders occur automatically according to pre-programmed rules, providing transparency and reducing administrative overhead)

- Tokens will be tradable exclusively between verified, compliant investors

- All ownership transfers and payouts will be immutably recorded on-chain

Public projections associated with the development estimate:

- $7.3 billion in total economic impact

- 900+ permanent full-time jobs

- Long-term regional tax base expansion

Additionally, the Forge Atlanta tokenization structure includes net token proceeds allocation to a professionally managed portfolio of investment-grade fixed-income instruments, subject to market conditions and final documentation. This reserve framework is intended to provide an additional financial buffer to support project obligations and future phases of development.

Core Platform Modules Available at Initial Deployment

At launch, Torch-RWA will activate the following production modules:

- Primary Issuance Engine – Regulated security token issuance with immutable token supply and pricing, designed to integrate with registered broker-dealers, ATSs, and centralized exchanges, subject to regulatory approvals

- Secondary P2P Trading Layer – Infrastructure for compliant, escrow-backed investor-to-investor settlement and connectivity to regulated secondary trading venues

- Governance and Oversight – Torch-RWA is being built with regulated intermediaries, and institutional-grade audit and reporting processes to support issuer and investor protection

- Automated Revenue Distribution Engine – Smart-contract–controlled income payouts

- Staking and DAO Governance Framework – TRCH-powered voting and ecosystem governance

- Institutional, Retail, and Administrator Control Panels – Role-segregated operational dashboards

- Integrated Compliance & Audit Layer – Continuous synchronization between on-chain and off-chain records

Future roadmap phases include multi-chain expansion, RWA-backed lending, and cross-jurisdictional governance frameworks.

TRCH Utility Token and Forge Allocation Mechanism

Torch-RWA is powered by TRCH, an ERC-20 utility token used for:

- Marketplace settlement

- Governance participation

- Staking and yield incentives

- Platform-native asset access

Forge Investment Advantage: Investors who use TRCH to acquire Forge RWA security tokens receive a single, integrated 10% token reward, available exclusively within the Torch ecosystem and subject to compliance eligibility. (This reward is provided in TRCH utility tokens within the Torch ecosystem and does not constitute yield, an interest rate, or a guaranteed return).

Referral Reward Program Supporting Ecosystem Adoption

As part of its launch strategy, Torch-RWA will introduce a structured referral reward program for the TRCH utility token initial coin offering, which will subsequently be extended to the Forge RWA security token launch, designed to support responsible token distribution and platform adoption.

The referral program enables KYC-verified and compliance-approved users to invite new eligible participants to the Torch-RWA ecosystem. When referred users’ complete identity verification and engage in approved activities—such as TRCH acquisition or participation in Forge RWA offerings—referrers may receive token-based rewards, subject to predefined program terms and regulatory requirements.

The referral framework operates entirely within Torch-RWA’s compliance architecture and is intended to:

- Encourage verified user onboarding

- Support organic network growth

- Increase distribution efficiency of platform-native tokens

- Strengthen long-term ecosystem engagement

All referral rewards are issued in TRCH utility tokens and do not constitute yield, interest, profit-sharing, or guaranteed returns. Participation is subject to jurisdictional eligibility, platform policies, and ongoing compliance review.

Launch Timeline and Network Expansion

Torch-RWA is currently in its final pre-launch phase, with:

- Initial deployment on Ethereum

- Progressive rollout of primary issuance, secondary trading, staking, and governance

- Planned expansion to Ethereum Layer-2s, Polygon, and Solana

Private access phases will precede full public activation (Private phases will be limited to identity-verified institutional and accredited investors, with broader access introduced as regulatory requirements are satisfied).

(**All security token offerings and marketplace functions are subject to applicable regulatory approvals and ongoing compliance requirements.**)

About Torch-RWA

Torch-RWA, operated by Torch, LLC, is a blockchain-based marketplace for the compliant issuance, trading, and revenue automation of real-world assets. The exchange integrates regulated security token standards, automated compliance enforcement, decentralized governance, and programmable finance to enable scalable, global access to institutional-grade real-world investments.

For more information, visit their website – https://torch-rwa.com/

Contact them via

Email: Jason@jmfcommunications.com

Visit Torch-RWA through

X (Twitter): https://x.com/Torchrwa

Telegram: https://t.me/torch_rwa

Instagram: https://www.instagram.com/torch_rwa/

Media Contact

Organization: Torch-RWA

Contact Person: Jason Feldman

Forge Atlanta

Media & Communications

Website: https://torch-rwa.com/

Email: Jason@jmfcommunications.com

1100 Peachtree Street Northeast STE 200

Atlanta

State: Georgia, USA

Corporate Office

Torch, LLC

1050 Crown Pointe Parkway

Suite 500

Atlanta, GA 30338

United States

Disclaimer(s)

This press release is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities, tokens, or other financial instruments in any jurisdiction. Any future offering of securities or digital assets will be made only by means of applicable offering documents, and only to investors who meet all eligibility and regulatory requirements.

TRCH is a platform utility token that does not represent an ownership interest in Forge Atlanta or any other underlying asset; economic exposure to Forge Atlanta’s cash flows will be offered, if at all, only through separately issued, regulated security tokens.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially due to risks and uncertainties including regulatory approvals, financing conditions, construction timelines, and market adoption of emerging technologies.

References

(1) https://www.coindesk.com/business/2025/06/26/real-world-asset-tokenization-market-has-grown-almost-fivefold-in-3-years

(2) https://www.marketsmedia.com/tokenized-real-world-assets-cross-20bn/

(3) https://www.developfultoncounty.com/about-us-news.php

Media Contact

Organization: Torch, LLC

Contact Person: Jason Feldman

Website: https://torch-rwa.com/

Email: Send Email

Address:1050 Crown Pointe Parkway

Address 2: Suite 500

City: Atlanta, GA 30338

State: Georgia

Country:United States

Release id:41038